23

September

2023

23

September

2023

Long before Covid-19, CFOs have grappled with competing priorities driven by traditional responsibilities paired with digital transformation imperatives. Today, the CFO and their tax and finance teams are continuing to play an increasingly critical role in real-time modeling and business structuring. These elevated activities require the ability to unlock capacity to meet both compliance requirements and the strategic demands being placed on the tax function. Tax leaders have become an essential strategic advisor to propose and defend business model changes and supply chain restructuring and to model desired outcomes in response to global economic recovery scenarios.

Now tax teams are being called into action to help their companies navigate new territory, from partnering with HR to assess the impact of displaced workers and remote models, to understanding financial resilience. “The crisis caused a flurry of stress testing exercises which triggered a surge in tax forecasting exercises. We’ve had to do two years’ worth of forecasting in 12 months, so it’s made us take a fresh look at our forecasting processes and how they can become more automated and efficient,” says Richard Craine, Group Tax Director at Barclays.

As stewards of how evolving tax policy will impact business forecasting and profitability—tax leaders will continue to play an increasingly strategic role with the C-suite. Drawing upon a recent survey published by Deloitte, of over 300 tax and finance leaders, this article explores what’s on the horizon for CFOs and their tax and finance leaders.

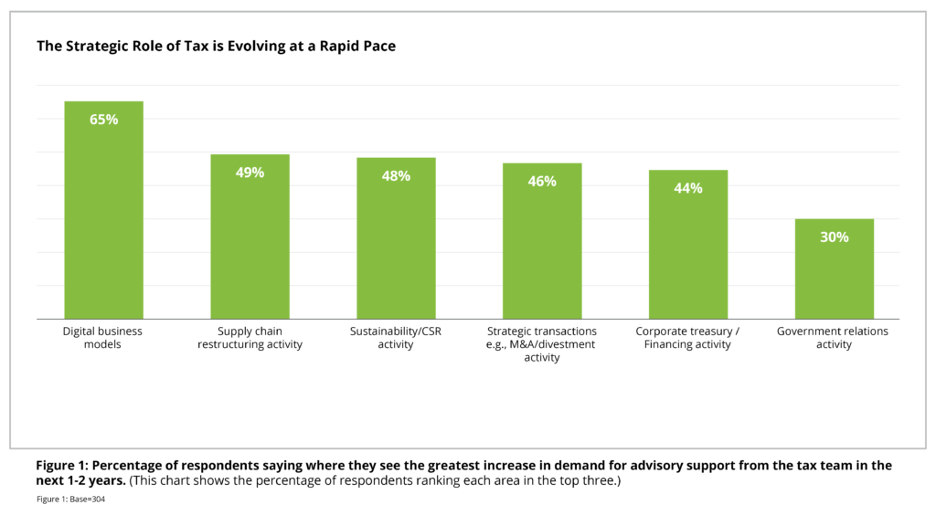

Some tax and finance leaders see the increased demands of the pandemic as foreshadowing of what is to come. Hybrid product-service offerings, sustainability mandates, digital services taxes, and shifts in compliance reporting protocols resulting from the digitization of tax administrations and real-time reporting requirements are emerging trends that will necessitate strategic guidance from the tax department. To meet the increased demands, CFOs and tax and finance leaders are taking actions now to create additional capacity and control costs.

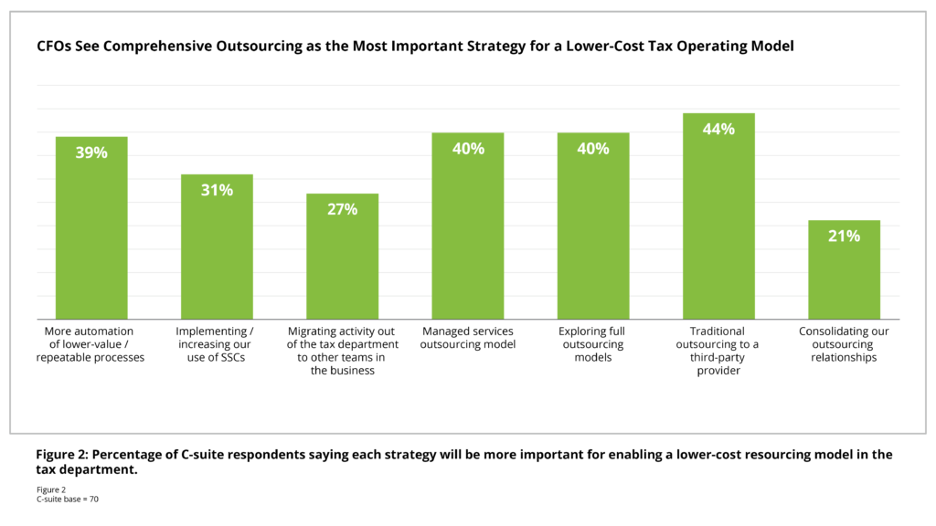

Demands for the corporate tax department to partner with the business are on the rise, but 93% of tax leaders say their department’s budget is flat or falling. To cope and control costs, C-suite leaders, most of whom were CFOs in this survey, are choosing to move increasing amounts of compliance and reporting work to traditional outsourcing providers (44%), managed services or full outsourcing providers (40%), and increasing automation (39%). The survey shows a gap between the strategies the C-suite see as most important (outsourcing) and those Tax leaders see as most important (shifting work to other parts of the business).

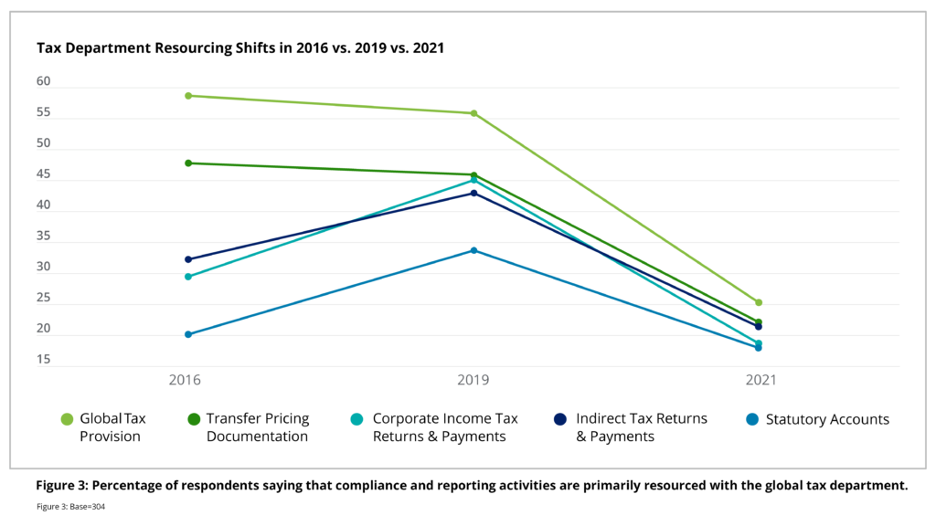

Historical trend data shows a dramatic move of compliance work out of group tax teams between 2019 and 2021, as resourcing models hit a tipping point.

Should tax continue to be primarily a compliance function or is there more to be gained? Tax leaders understand the complex implications of adopting new digital product and distribution models, tax credits, grants, and incentives, and the impact of government sustainability policies. CFOs need to be assessing where the tax department can add the most strategic value to the business and what options are available to increase capabilities and capacity without increasing costs to enable this to happen.

Read the full Deloitte Tax Transformation Trends Survey: Operations in Focus at: https://www.deloitte.com/taxopssurvey